Friday, September 30, 2016

9/30_AUPH, NVFY_Same Mistake!!! shorting on frontside with size and refuse to cover into dips!!

This chart is EXACTLY same as OPTT!!! My initial short got filled in low $3.00s but obviously I was wrong. It kept going. I don't regret my short. That wasn't the problem. As a trader I was wrong countless times. The real problem was instead of cut the position, I added to loser trying to make it work and only covered 1/3 of size into dip. 2nd mistake was my fat finger mistake covered into .40s which ballooned my realized loss to $2800ish. At this point I have to admit I was on fire. I felt unconfirtable and paying attention to every candle and print on time and sale. My read was correct but my action didn't comply to what's right. That $3..40 piercing and held really surprised me. I thought very likely it would breakout and stuff but wrong again. It started to base at .50s but barely kept its upward momo. This action got me interested so I reshort using CP at $3.56. Then finally big volume stuffing candle came and it was the beginning of the end. Same mistake as OPTT, RGSE, CATB. Gotta exhausted on the frontside of the move and lacked courage and stamina to attack the backside.

Chased down ss but didn't pan out as I planned. Stopped out. The best area to short is above .50. you missed you passed!!! There is always another trade next corner!!!

AUPH got me exhausted and lacked of conviction and confidence so didn't trade it appropriately.

Trading is never easy. It's easy to get emotional and lost sight of right things. But what Can I do? I am human and I play real money! Tired.... This is one of the most ridiculous weeks. I made big and lost big at the same time and I increased size dramatically. But after what's happened I am fortunate to end this week and month green net $11k profit. Trading is all about being able t survive. Almost every day this week I started red, 1k, 2k, 3k realized loss but I made great comeback!! That's true the gift of mine being able to bounce back from dark abyss. Resilience is the key in this career!!! Starting next month, Reduce size the first half hr of the day and ONLY hammer big when valid resistance is spotted and conviction is on !!!!! Trade what you see not what you think!! price action is the key!!!!!

Thursday, September 29, 2016

9/29_CLRB, NXPI, TOPS, CATB, AEGR_Ridiculous Day~Lost my Mind! Never will do it again!!!

Due to small cap, biotech pharma mania I saw the news with CLRB. Turd but former runner. News is on phase1 which is of no value but understand we are in crazy market so I longed 3k shares immediately then boom someone sold shares into my bid and instantly I was down $2k. Fuck that I knew seller exist so hoping it could get picked up at least some momo to offer me the exit. Fortunately got that and sold my position lost $400. No biggie. But this is not appropriate way to trade! Anticipatory approach from long side is essentially tossing dice.

Didn't move as expected. No seller and time stop loss got triggered so got out.

Had conviction on it. They talked about approval in Japan and previous ODD. But it didn't sell off like SEED yesterday which is what I expected it would do. Had decent short on ST account so managed to made $2k on it.

Man~ this has a lot to talk about. Saw the PR it put out related to SRPT so I thought if the momo gets picked up it could fly so I took 2k shares long. It did exactly what I wanted!!!! BUT I sold because big green candle look like emotional para to me and flipped short. Got squeezed! I don't regret short because I saw the weakness and risking $7 mark. I don't regret long and sold b/c I didn't expect the volume explode like that. The only thing that I did wrong was seeing 2 red volume push downward but failed I should cover immediately!! I knew it could squeeze to infinity, this chart reminds me of LEI on day 1 so after I covered I went long and chased higher BUT didn't sold my position at least half the next candle. This is what happen!! Even when the stock is in squeeze mode, a slight weakness can bring it down!!! You don't know how many shorts were still left covering there! Maybe they all have already covered and it would start down trending. This is the speculation part of trading!Not trying to guess the top but as soon as the weakness is spotted you can start shorting risking HOD. After all being said and done, I took $3k loss on short side. Not the end of world but I am pissed. I kept looking for plays where I could make money back then NXPI popped.

Not ideally setup but I knew that the stock pop up big can't sustain it's upward movement without pullback so I ss some. It kept going then I ss more basically risking HOD. I had 800 shares and the loss mounted so I had to cut it. Glad I did b/c it went to $97 later. I shouldn't take the trade b/c pullback is right there-the 3rd candle!!!! but holds!!!Remember last time SRPT's dip got absorbed it kept going without looking back. Definitely not my niche. Had I not taken loss on CATB I probably wouldn't play too big wishfully hope to make money back. Casino trade!!! Deserved the loss!

At this point 1pm I was down $5k on my CP account and up $1700 on ST. Definitely bad day and got me irritated. I decided to look into CATB and make one last shot to make money back. the news is of no value I know that as fact, the only reason it is up b/c of momo and together with SRPT on the headline. I knew $7.50 is the lvl for POS but i doubted it could get there. Then I saw volume surged towards $7.20 so I took 2k shares ss. I covered at $6.96 b/c $6.95's got big bid and I really don't think it would pull so fast. I thought I could still chop around until 3pm before the reversal. Again out of my surprise it pulled big! I have to adjust!! I knew there were probably too many ppl long it and now bag holding it so I reshort more. I don't know truthfully because of my conviction or the price action or my mood and revenge mentality I started sizing in BIG into the last bounce! I didn't patiently wait for the volume surge to size in b/c I was afraid it could just pull and crack support big time. So Essentially i was a chaser. I lost my mind!!!! I ss 5k shares at $6.39 and added 5k at $6.40ish. Ended up holding 14200 shares with $6.49 avg. I really thought $6.50 would peak out and selloff into the close but wrong!!! It kept bouncing to the point $6.60ish. At the peak I was down $2k. At that point I could feel my body was shaking and kept thinking what if I am wrong, what if, what if.....etc. Maybe things have special way for working out I was right at the end. But still due to fear I covered half-5000 shares at $6.50 and 2k at $6.40. But I rode 7500 shares down to the very end. It didn't do what I expected. I don't know if it's rational or I am ultra bearish on it. I really thought it could bam bam bam selloff into the close so I could cover at high $5s. Didn't pan out as I planned so at 3:59pm I took the offer at $2.25. Was on the right track definitely but it was a chase trade with size!! fully out of my mind and eagerly wantted to recoup losses incurred earlier. It's the first time and has to be the last time I did this! Will never do it again!!!

Wednesday, September 28, 2016

9/28_OPTT, SEED, SAEX, RGSE, CCCL, SMIT_1st 5-figure day since trading fulltime

Thinly traded premarket and knowing the fact that we are in the crazy and wild low float on fire market, why the hell I shorted risking HOD thinking it would get rejected??!!!!! Not good way to start the day!!! saw stuffing then doubled my position. Afraid of continual pushing I covered half and realized $2k loss. But strangely I was feeling okay with it because knowing the fact we are in crazy market and being confident that I will make it back and more later the day. Nice cover near the bottom. Then reshorted it but unfortunately didn't workout as expected so I left it alone.

Biggest gainer of the day but didn't maximize the profit. I took 6k position and covered all when absorption was seen then boom it cracked. I shoulda gave it more time at least until 10:30am but I have to admit I got scared and let fear took over. Afraid of being wrong, afraid of getting squeezed like yesterday. I knew it was parabolic action and most bids and buying were contributed by shorts covering but man still couldn't hold it longer then I should. Then reshorted 6k shares definitely was driven by emotions and vengence mentality but I tried to minimized the impact of it by focusing on the price action. Risking $.40 over/under/hold/not. Glad I was on the right side of momo and later it went down to $4.50ish but I am glad of my exit. The ONLY regret was morning cover due to fear.

AT09 banked $20k on it and I screwed up big time!!! I had conviction it would crash after market open but didn't take the trade in the premarket. I was going to but my order couldn't get filled. My ideal entry price is $3.50s but it just couldn't get there and I think the main reason was it got bashed by John welsh at 8:30am. Knowing the fact it got bashed I should chase but I didn't. These 2 days I let a lot of opportunities pass by because I didn't chase. Sometimes you should!!!

easy trade.

This is the one I chased but it didn't quite workout perfectly. The reason I chased was because RGSE pulled big so I thought it has killed all the momo names. Nope it spiked but turned out to be breakout stuff move so I doubled up. Perfect exit!!

.

Late day trade but didn't trade it quite appropriately. $3 stuffing got me interested so I asked 2k locates. I planned to trade small and scalp it b/c I didn't want to ruin already awesome day. But the volume surge towards HOD got me interested so I asked another 3k shares anticipating HOD push fail. It did exactly what I thought BUT I didn't exercise patience for scale out. Later the day it went below $2. This is what happen when you have bunch of inferior and weak retail buyers in the stock. Knew it BUT man when you see the profit you just want to take it and especially when you have a great day you don't want wait around and have possible headache even though the price action tells it could go much lower. .... Gotta work on that!!!! Remember every trade is independent!!! the decision you make shouldn't be anything other than price action and chart!

Tuesday, September 27, 2016

9/27_RGSE, INVT_Exhaustion, Discourage, Frustration got me off it then boom~it cracked!!!!! lots of lessons!!!

Just like CCCL but glad I covered some into the pullback thinking it may get crowded. Proud that I re-attacked into the bounce! Turned red trade into green!

Crazy black swan appeared today and I am sure lots of people lost their ass big! I took short initially risking HOD but it started grinding up instead of pulled back down. I was waiting for that bail out pullback but it never came so I took the offer and got out and that was the best thing I did today!!! It kept going and volume started pouring in and that dip got me interested. It seemed no seller and big bids absorbing there so I longed some then it just took off and game on! However I should have kept half for ride but didn't. It's hard. When you are in the slump and cold streak and all the sudden you were up $5k you just threw all the rationale, logic, chart, price action our of mind and took the profit.

Surprisingly the craziness continued...It was choppy in the midday and I thought it would probably stuff couple times near HOD and pull at the end that was the typical scenario recently but nope.. wrong!!!! Massive absorption in the .80s, .90s and then it just took off and made secondary spike! I shorted countless times and all wrong! Each time I was wrong I took $200-$400 loss. No biggie. I was actually very proud of my cover on each short attempt, I remained disciplined, otherwise my loss could snowball!!!!!!! However one the biggest regret I have was I got exhausted on shorting. Just think about it, you shorted 6 times and wrong 6 times, are you going to short the 7th time?????!!!!! most likely I wouldn't!! then boom!!!! it turned out the 7th time short was the ideally POS. It always seemed easy and crystal clear on hindsight but it was difficult when facing uncertainty. As short seller, you gotta keep trying!!! I admit that I got exhausted, discouraged, frustrated so I took my eyes off. I didn't perform the best I could today. Yes I made money today BUT there were a lot of things can be improved. Timing! Trade Execution! etc......

Monday, September 26, 2016

9/26_ARRY, SMMT, RGSE

Winner of the day. Minimized the gain but still decent.

MR lost on it. Totally totally unexpected move!!!!!! The reason I was on the long side initially was it's got 90m float, JP Morgan came out with big price target defended it along with others with various price target. So I never thought about shorting it till midday looks like HOD stuffing action but I was wrong. Extremely strong stock!!!! The best is stay away. No edge Trading it!! The only edge is buy dips in the morning and looking to either scale out or hold.

Greedy. Should have sold half into volume push. It was clearly fake out breakout!!!!!!! But fortunate I got out before the herd did.

Friday, September 23, 2016

9/23_SAEX, MRNS_underperformed

Was right initially. Short biased risking $11 BUT the setup look squeezable so I covered all. It was hugging the VWAP and when it cracked premarket low it bounced back up so I got scared and covered. Later I reshorted but it's too late to profit.

took eyes off because patience seemed never workout for me. BUT boom!!! it cracked.... It seems whenever I exercised patience the setup didn't workout and when I gave up on it it worked!!! LOL.

The idea was right. it's up on board news so definitely is a short but I was being early. I focused on SAEX so missed the reshort.

Thursday, September 22, 2016

9/22_SAEX, BSPM, GALT, NEOT, EXBG

it's always painful to do a blogspot after a terrible red day but what else can I do?

Turned big green day into red day! Should have covered everything when the pullback was weak! Didn't even tough the VWAP!!!!!

Mistake No.2: just because it's not short doesn't mean it's a long!!!! I longed 4 times and all failed except last time. This is trading! If you are not careful, it's sooo easy to turn winner into loser!

Bread-and-butter play but I screwed up. When stock have premarket action and it does parabolic morning push towards whole dollar mark, you gotta short!!!! You gotta short BIG!!!!! I missed the execution for GALT and for BSPM it moved too fast and I couldn't get my order in! should have put order in before the open!!!! Just like GBSN, these low float move tooooo fast, you can't use reactive approach!!! You have to take anticipatory approach to scale in!!!!

Turned big green day into red day! Should have covered everything when the pullback was weak! Didn't even tough the VWAP!!!!!

Mistake No.2: just because it's not short doesn't mean it's a long!!!! I longed 4 times and all failed except last time. This is trading! If you are not careful, it's sooo easy to turn winner into loser!

Bread-and-butter play but I screwed up. When stock have premarket action and it does parabolic morning push towards whole dollar mark, you gotta short!!!! You gotta short BIG!!!!! I missed the execution for GALT and for BSPM it moved too fast and I couldn't get my order in! should have put order in before the open!!!! Just like GBSN, these low float move tooooo fast, you can't use reactive approach!!! You have to take anticipatory approach to scale in!!!!

Wednesday, September 21, 2016

9/21_CLVS, EBIO, BSPM, CLCD, GALT

Not easy day....but I traded the best I could

good entry and good exit. History told me should never overstay. Was thinking about reshort into pop ideally VWAP rejection but man that pop is too big and I got scared so didn't reshort.

Late day volume surge got me short again, I treated it as big picture trade and I had good entry so I stayed patient but didn't workout. Good exit or the loss would mount!

Big chart, over-extended so looking to ss. Big picture trade but like Shadkin said the setup deviates from my plan so I covered. I was looking for more volume selloff and weak bounce.

Awesome opportunity to short at $4. Was thinking to do it at VWAP but got busy with other players. Had I shorted at $3.80ish I would definitely emotionally cover into $4 push. The only thing was I should have gone bigger!!!

Crowded. Should have covered earlier.

Killer reshort into HOD push failure. Covered half into washout. But the other half didn't workout.

good entry and good exit. History told me should never overstay. Was thinking about reshort into pop ideally VWAP rejection but man that pop is too big and I got scared so didn't reshort.

Late day volume surge got me short again, I treated it as big picture trade and I had good entry so I stayed patient but didn't workout. Good exit or the loss would mount!

Big chart, over-extended so looking to ss. Big picture trade but like Shadkin said the setup deviates from my plan so I covered. I was looking for more volume selloff and weak bounce.

Awesome opportunity to short at $4. Was thinking to do it at VWAP but got busy with other players. Had I shorted at $3.80ish I would definitely emotionally cover into $4 push. The only thing was I should have gone bigger!!!

Crowded. Should have covered earlier.

Killer reshort into HOD push failure. Covered half into washout. But the other half didn't workout.

Tuesday, September 20, 2016

9/20_SRPT, BSPM, CLVS_same mistake as yesterday's

shorted para but failed to cover into pullback above VWAP. This is the frontside of move!!!!! There is this feeling that it's hard to cover which tells me it's got momo! it's not ready to ss yet!!!!! Same ticker, same mistake as yesterday!!! Definitely this one is not easy to trade and setup differently than others i am good at. Cover at the top again.... terrible avg got me emotional.

Main gainer of the day, nice entry, nice cover. then nice reshort and nice exit. Out of my surprise it squeezed big late day. ss it but didn't work out as planned. Took it off.

Not easy one and Mr. Account Killer!!!! at the top I was down big!!!!!! good exit!!!! better avoid it in the future!!! not worth the risk and time!

Monday, September 19, 2016

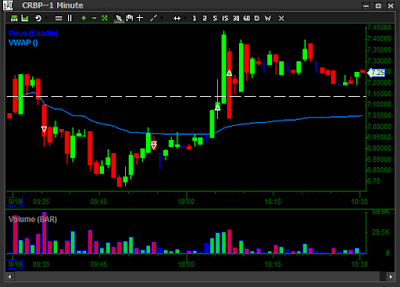

9/19_SRPT, AERI, CRBP_BLOWUP DAY

AERI-FOMO trade. Should have covered when it failed to breakdown and holds above VWAP.

CRBP same as AERI, when no selling pressure existed and moves near VWAP, cover!!

blowup trade. There is no reason short big without escape plan on the frontside of the momo stock!! Especially it's up on big time FDA months waited news!!!!

2nd short was the blowup one. Influenced by Nate saying it's got stuffed near previous lvl so I took ss. Didn't have escape plan and got fucked.

Sighing... another regret of the day. due to $34.60 avg. I emotionally covered into HOD-$55 push. Was planning to risk at $44.75 lvl but it went over 20cents.... trading is not exact science!!!! It's more like an art form!!!! This is the mistake I kept making again and again. Emotions play huge role in trading!!!!!! The power of observation make you the king@!!!the funny thing is I saw it very stuffy near the top but still covered into it....MUST give self more wiggle room!!!!!

Friday, September 16, 2016

9/16_AERI, WATT, CDOR, GBSN_ZZZzzz WEEK

Perfect cover before the massive squeeze! Did midday boredem ss didn't workout.

Usually wouldn't ss during this timeframe but toooo bored and this turd ran up too much and AAPL pulled today so took ss, didn't workout.

Big miss!!!!! Had chance to ss but didn't pull the trigger. 1m float sortof make me scared to ss....massive liquidation.

Biggest regret of the day. My bread-and-butter play but afraid to ss at $3. I feel the more I trade, more experience I have, more hesitatnt and less likely to take action when I see something. Too much painful memory in the past and sluggish recent performance recently got me hesitated. This is the part of trading that really annoyed me. When the time is right, play is right you didn't play enough size and ended up you missed big and you told yourself I will size the fuck up next time then you end up ss tooo big tooo early. Sighing... that's part of the trading you need to get over with. Eliminate the emotion 100% and just trade it.

JUST TRADE IT!!!!!!!! Don't think too much!!! of course have set risk!

Thursday, September 15, 2016

9/15_DWTI, NETE, ACST, BSPM_2 BIG mistake!!!!!!

premarket plan: ss into $90 and looking for fade below it but the setup deviates from my plan.

It puts peak at $92 then retraced. It traded inversely with USO. I emotionally covered at the top when USO made touched previous low. Totally totally emotional trade due to terrible entry I had. Had I had better entry/average, I would use $92 over/under as a guide.

NETE-I traded right, it looked very stuffy and I was right 2 hrs later. Did the right thing but went out for lunch and missed the reshort opportunity.

DWTI is the 1st big mistake and ACST is the 2nd big mistake. My plan was weak open, ssr on then squeezed but man this is clearly parabolic and r/g fail push. Why did I even long it??!!!

Huge gap down but was thinking it may be crowded so long some. didn't workout, small loss.

Subscribe to:

Comments (Atom)