-Even thought I saw this chart a few times but still fucked up myself.

-this chart is no different from PBMD, CANF. I started shorting early and ended up holding 2000 shares with avg. $13.11.

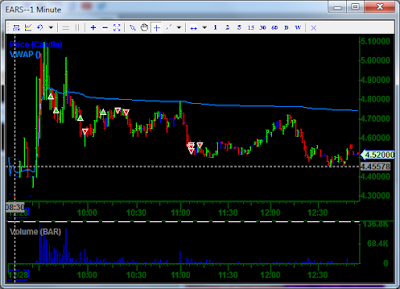

-the 11am reclaiming action should stop me out but I didn't and instead I let my loss snowball.

-You don't know whether it got crowded until the chart tells you. I had two chances(at $13.60's & $14.0s) to get out but I chose not to b/c I didn't want to realize the loss.

-the problem was I focused on p&l instead of focused on making a good trade and at the end this loss wiped out my entire week's hardwork and profit.

-I broke my rules again:

1) didn't cut my initial short when it went against me.

2) didn't cut my entire position when it reclaimed VWAP and started basing previous support after 11am. After all had been done, I took $4000 loss. The loss could easily become 5x, 10x bigger if I traded bigger size. If you can't be disciplined and refuse to cut the position and realize the loss then this job is not for you! Come sit down and think about it!!

-this trade reminds me of Tim Grittani and his trades. We have similar trading style by shorting parabolic. The strategy works 90% of the times and it enables you to remain consistent BUT there are two things to watch out for:

1) Always have a plan and predetermined stop loss level, stick to the plan. No plan, no trade.

2)When the pullback comes, do you hold or cover??!! look for signs! I was constantly influenced by P&L, I had a few hundred unrealized but didn't take it and next minute it became a big red number so I refused to take it off and that was when the situation turned worse and loss became uncontrollable. Always have a plan and stick to it NO MATTER WHAT!!!!

-always respect what your body is telling you, I could realistically feel uncomfirtable in this trade and my inner voice kept repeating "please crack, please go down". The short at the very beginning was a mistake, when you were wrong, be wrong!!! there was no point fighting!!! Whenever I decided to fight, I ended up with HUGE loss! Don't fight!!! Trading is never about fighting!! Trading is never about battling!!! When George Soros felt back pain, he exited the position.

Following are the points I was influenced by:

-"It's not loss until you realize it". I allowed it to take control of me and ended up eating huge loss

-I told myself, "give it more time to play out" and I watched it geared farther away from me.

-I neglected the bigger picture, news, volume and shorted morning para based on my assumption that lots of resistance ahead of it and never would thought that these resistance would get ran over.

-I did see the volume was massive when it opened and thought about taking it off but didn't act quickly enough, it moved way too fast upward. I should have just slammed the offer and got out!

-Was thinly traded premarket and this one wasn't gapping up and para so there was no point to short at the very beginning!!!!!! think about it!

-had I used in combination of 1-minute, 5-minute and daily chart to trade, I would probably take it off due to the massive volume and trend holding action. I was staring at 1-minute chart and overlooked the bigger picture chart.

-I don't regret trading big, the only thing I feel bad about is not immersing into the chart and respecting what the chart was telling me and tiptoed to fight. I could CLEARLY feel no selling pressure there because it seemed difficult to cover and traded in the top 25% of price range most time. Why fight????!!! Whenever you feel frustrated, anxious, bad about trading, take it off!!! Do what your body tells you to do!!

-It reminds me of Monaco trader's quote on holding a cup of water, the longer you hold it, more exhausted and paralyzed you would be and it distorted your judgment, mentality, well being and action. Keep trading simple and short as much as much. Stop giving it time, stop giving it chance!!!! Eat the fucking loss and move on!!!

-You have to understand no single trade will make you wealthy or change your life b/c human have infinite desire and wants but only have limited resource. Doesn't matter how much you make, you would think it is never enough, you always want more!!! That's not just you but the nature of human being. However, if you let one trade gets out of control, it can wipe out weeks, months, years of your hard-earned capital. At the end you will forget about these trades, how much you make or lose on it. What only matters at the end is the result. Trading is the net game!!!! It's life long marathon. You want to be a career trader, someone has NO attachment to any single trade. Someone that stays in this game 5,10,20 years. What's the meaning for a trader that consistently made profit for 5 years-10million and lose it all at the end??It's hard to visualize and you don't know how you will react to it until it happens. Think about it!! I know a lot of traders blew up today. Even one of the best traders Modern Rock lost. It's okay to lose! We are human being. We have emotions, feelings. You have to be aware of it!! Don't feel bad that you lost!! Treat it as an opportunity that you can learn from it so that you can avoid bigger loss in the future trades. Daytrading is the most difficult job when having days like today. But learn from it and try the best you can in the future. Remember you gotta be disciplined no matter what!! Cutting losses at predetermined level is life-saving action. It's not a choice but a MUST if you want to stay in this game. Will continue reading psychology book this weekend and try to do the best I can next week. Remember the sun will always rise, the market is always there, live to fight another day!