DJT -long attempt failed and took decent loss then revenge traded CVNA and got ramped again. Bad idea shorting e/r winner on the gap. paid the price and ended my 17-day green streak. back to grind

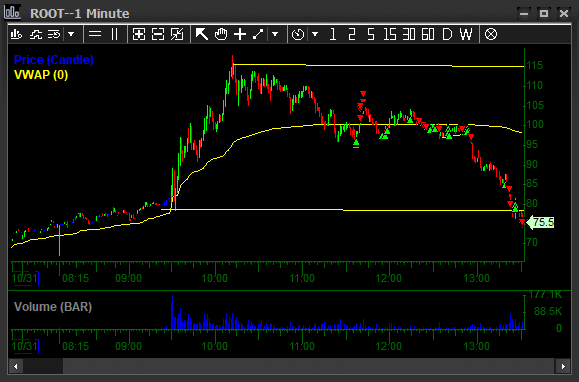

ROOT-the first long trade make me money make myself instant long biased and I decided to long it in despite of its failing follow through action.