Wednesday, July 31, 2019

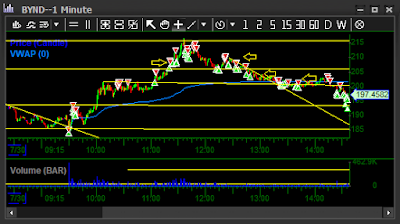

7/31_BYND, OSTK_HARDEST stocks I have ever traded

can't believe what it does... after heavy selling yesterday it could still climb back up above $200. I stepped in too early again but glad I stopped out before re-attack it.

OSTK-undeadable action again. big daily chart, scam company, over-extended, pumpish PR...lining all things together=short and its the first sign of weakness so I dabbled into it..nope...wrong again..

now I am fully convinced SPY selloff is the contributor of both OSTK and BYND's selling. they both came back along with SPY's rally. that's it...not gonna touch them ever again!!! unless absurdity occurs

Tuesday, July 30, 2019

7/30_BYND, OSTK, AAPL_nothing worked! frustration to max.

BYND-same mistake as SOLY. down big 15% and i thought that's it, this over-valued stock is done but again timing is dead wrong. I ended up shorting too early and got squeezed then I was thinking maybe lots of shorts got fucked and these people have bigger scheme so I flipped long and ended up dumping in my face. Literally every pop got stuffed when top is put in.

OSTK-venom ticker. this thing just like BYND got 9 lives.

APPL-thinking it's got no innovation and the market is already saturated so maybe they gonna use buying for unloading and allocate their $$$ somewhere else. WRONG again!!

Monday, July 29, 2019

7/29_BYND

finally momentum shift!!! due to confidence and FOMO I entered tooo early thinking fast rejection. $228 is my starter size-500 shares then add add. at the peak was down near $4k..certainly not ideal. but trend is on my side so I nailed the meat. had I patiently waiting for lower high lower high I would score much much bigger!!!

entry just as michail said determines if you are wrong you will exit with minimal cut and if right you hit BIG score. bad entry results that even if you are right in the end you will end up shaking out multiple times.

Friday, July 26, 2019

7/26_SMSI, BYND, OBLN

BYND-venom ticker. keep making surprise. avoid in the future!!!

SMSI-lull fuckery action. no thanks. glad I only kept small portion on.

only 3m volume and seller at high 7s and couldn't reclaim $8 which is key lvl. and time stop triggered so i got out. great one!!

spetacular action again on BYND. bet everyone thought this is dead after it went from $240s to $215 but wait a minute $200 psyco lvl holds that's a big bullish sign. It grinded all the way back towards $240 then it became choppy from there. no clear direction just channeling. they did fantastic job to shakeout weak longs. every weakness turns out to be buy and strength=sell. big picture don't work unless you have $150-$190 average.

Thursday, July 25, 2019

7/25_BYND_BLOWUP TRADEs

I should know for better this is the type of action/stock I want to avoid. the gain is just not worth the risk!!!! just like SNAP 2 days ago. fuckery action all day long. I been ss into weakness and cover/buy into strength all day long. they did fantastic job to induce short sellers in it. every time I saw big red candle I thought "this is it"...WRONG!!!! it never have the "rejection" I wanted and it holds with consistent volume and higher low's, never dip below VWAP that's big big red flag for shorts. Again I should have taken 3-4k loss and walk away.

Wednesday, July 24, 2019

7/24_JNCE, SNAP, IRBT, DMPI, FB

i seriously need some break and mental restoration. heading into the day with nothing much and saw JNCE as top percentage gainer so attempting longing it thinking $5 hold. wrong. casino approach.

then SNAP shorting into resistance but nope it kept going. I covered the most but let 2k shares get away. IRBT was oversold so I longed it but didn't do much and selling continue so flipped short thinking back down to $70's then find base there. worked out well. DMPI-small cap running and managed it the best I could.

thinking the entire world including big banks, institutions, retail traders are shorting this pig. no thanks. it's like TSLA those days at $300s.

pre-planned trade is usually the one that works out. if wrong the risk is set.

Tuesday, July 23, 2019

7/23_ITCI, SNAP_back to Square 1

Due to frustration and losses i decided to longing hit piece thinking fundamental will bring it up. ended up add add add kind of situation and all it takes is a over-sized position to wipe you out. even if you stick to the risk lvl you pre-planned. the spread and volatility kills you still.

thinking to put a brake on my trading journey for a moment. can't afford to lose anymore!!

revenge mode is fully ON!! mistake: smashed bid gambling the earning guessing it will go down->WRONG. mistake 2: left some and put add on despite unexpectedly strong action.

Monday, July 22, 2019

7/22_BYND, APRN, CRWD

APRN-sympathy to BYND and saw volume today so chased it, didn't pan out like I wanted so I bailed it

BYND-man. this is the star of starts. once it take off, every dip got sulked. ain't coming down.

CRWD-the previous dip holds so no thanks. awesome trade.

Friday, July 19, 2019

7/19_CRWD, BYND

BYND-will be on my do-not-trade list. shit is choppy as hell. I traded it the best I could.

CRWD-good trade then realized it's choppy so stayed away from it.

Thursday, July 18, 2019

7/18_NFLX, OTLK

NFLX-ez money is gone. what's left is conviction patience all day hold. expect choppiness

OTLK-very happy the way I traded it. larger relative volume, stick tape, holding action ..all red flag!

Wednesday, July 17, 2019

7/17_GHSI, APRN, FRAN

APRN-was quite bullish due to thin in the air and pr mentioning BYND but chart has to prove itself. time stop hit and massive resistance in low $11s so fuck it I sold. I could always get back later.

FRAN-ez trade but scalped it.

GHSI-had I had shorts I would probably get stuck. this is type of shit got me screwed over and over again thinking it's up too much it's got pull. Nope. not until backside hit. rather miss that early!!!

Tuesday, July 16, 2019

7/16_APRN

not much going on in the morning so I went upstairs and came back and it already took off. Not gonna chase the longside but cautiously waiting for pop to short. flipped between long and short until the last hr it couldn't go as I wanted so I smacked the bids. news is very pumpish and float is small. Ideally $10.50 hold tomorrow for firework.

Monday, July 15, 2019

7/15_CAPR

shit could hit the fan today and this is the type of name I ate 5-fig loss. Glad I avoided the downfall. Little trivial thing often contribute to big downfall in the end. I located 2000 shares today so I carried scalp mentality into the game and which allowed me perfect in this case. channel action essentially so I shorted into each volume recapitulation. Had I located 10k shares I would definitely get my feet wet a lil then I add add add and stop out near HOD. prop on these guys who manipulated this pig really well. I avoided lots of traps thru the day that I am very proud of. trading these low float name you can't have patience if things hanging around. the stock has to fit your mental picture like glove. slight deviation meaning GTFO!!!

Friday, July 12, 2019

7/12_VVPR, SGBX

right on both plays.

VVPR-noticed thin up and down but volume isn't there and lots of sellers and chatroom chasing so thinking if it holds with higher relative volume and new high then no thanks.

SGBX-huge rejection premarket leads me thinking it's going to reject again.

Thursday, July 11, 2019

Wednesday, July 10, 2019

7/10_VISL

Overall I traded it okay. the only mistake I made was shorting into bounce too early and got HOD fake out breakout but I noticed it and sized back in. left tons of meat on the bone but that's ok.

Tuesday, July 9, 2019

7/9_CEI, OSTK_for better/worse, I took my car for servicing..

Nasty trap and unexpected action. this is very rare, it happens ONLY 2-4 times/ year. But given its action and volume it's possible. plus locate are available, massive volume absorption and bash by everyone, the entire sentiment is quite negative and given unreal seller at $5. Just put everything into consideration it's a "short"..but wait a minute..it held all the time and volume is there...surprise!!

I took my car for tire replacement and on mobile the whole time for better/worse. live to fight another day.

Monday, July 8, 2019

7/8_KPTI, OSTK, RAD, SOLY

Small cap is dead and mid-large cap is difficult and choppy to trade.

KPTI-idea is right and overall direction is downward but not type of trade I looked for. too slow

OSTK-could have stopped out earlier by hitting the offers. kept the bias and hesitated.

RAD-r/s and breakout thinking they used it for unloading. nope. slow stead grind action. pullback magnitude theory don't work in this case!

1)wait for it to get to the point that if I were short I would panic covering.

2)it's got history of fail follow thru in late day.

3) thin in the air and lots of refreshing bids. ideally $20+ push tomorrow for all day fade.

Tuesday, July 2, 2019

7/2_BYND, MDJH

BYND-again like yesterday. idea is right but timing is off. frustrated!!! sold it again near bottom. "they"did fantastic job shaking out weak hands.

MDJH-revenge mode turned on and trying to squeeze this tiny float china name. I guess no one is there due to July 4th holiday. drying liquidity is the pain for taking long position.

Monday, July 1, 2019

7/1_ADPT, BYND, IEA

ADPT-what a fade. when a stock is under selling pressure. SSR can't help it

BYND-afraid $150 crack then it flush to $148 quickly so got out due to fear.

IEA-glad the way I managed the trades.

Subscribe to:

Comments (Atom)